Real Estate

Rental Rate Optimization: How to Price Right and Maximize Occupancy

August 22, 2025

BLOG

Real Estate Data Intelligence Pipeline: The Competitive Edge Property Managers Need in 2025

Property managers don't need more dashboards; they need intelligence. This article explains how real estate data intelligence pipelines unify existing systems and use AI/ML to deliver decision-ready insights. From rent pricing and churn prediction to forecasting and automated reporting, pipelines enable property management to shift from reactive to proactive. Firms that build them today will be ready for tomorrow's data-driven real estate market.

How much rent should you charge? It sounds simple, but it’s where most landlords lose money before a tenant even moves in. You overestimate and set the price too high, and your unit sits empty for weeks. Conversely, you set the rent too low, and you bleed cash every month without even noticing.

In a market where a single vacant month can cost you thousands, rental rate optimization isn’t a “nice-to-have.” It’s the difference between predictable income and surprise shortfalls.

In this article, we will break down the pitfalls of rental pricing and ways to optimize it to unlock your property’s full potential.

Why Rental Pricing Is So Often Wrong

A Federal Reserve Bank’s report revealed that U.S. rental vacancy rates rose to 7.1% in the first quarter of 2025. Previously, the rate was 6.6%. This means landlords all across the country are spending more time and losing more money with empty units. The reason for this collective loss is due to rental pricing mistakes that we are about to uncover.

Mistake 1: Relying on Outdated Listings or Rough Averages

The standard process for rental listing, followed by most landlords, is to follow the prices listed on other platforms. So, most of them check Zillow, Facebook Marketplace, or Craigslist and average a few similar listings.

The problem? Many of these listings are either outdated, artificially inflated, or not yet leased. Moreover, those numbers reflect asking prices, not the actual closing rents. This gap between the two numbers leads to misinformed decisions.

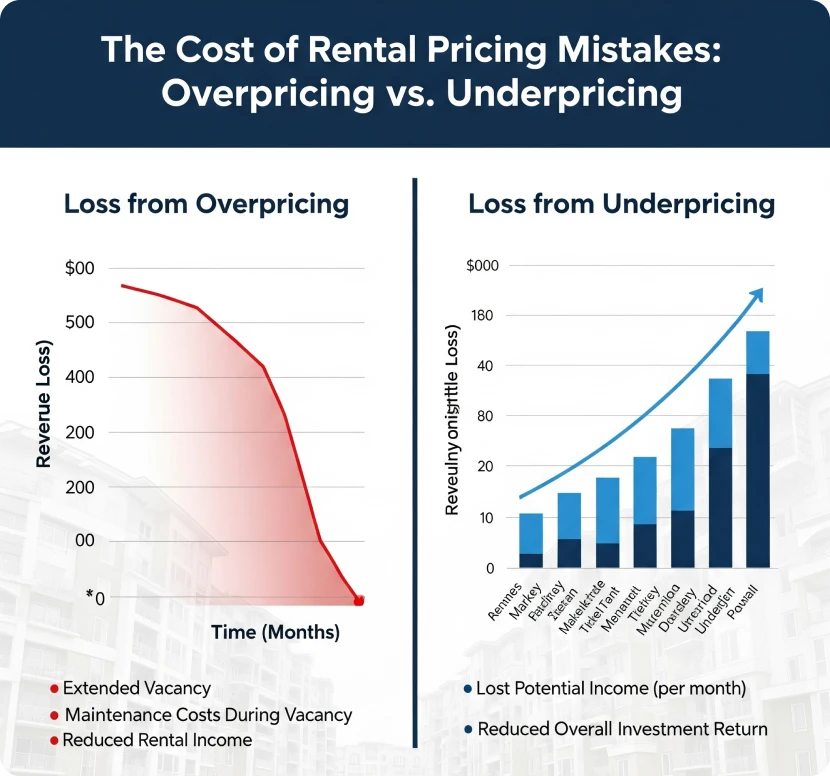

Mistake 2: Overpricing Out of Optimism

Everyone thinks that they have a pot of gold that nobody can replicate in their area. We agree that it is tempting to price your property with a higher tag. Especially if your unit has new appliances, fresh paint, or you feel it deserves higher rent. But you have to understand that if your unit sits empty for even a month, the so-called premium evaporates.

Let's understand this with an example. If a landlord in Vancouver priced a 2-bedroom at $2,700 based on nearby listings. While the actual demand curve supported $2,500. Due to the inflated price, if it sits vacant for 3 months, the owner will end up losing $7,500 in unrealized income.

Mistake 3: Underpricing to Avoid Vacancies

While overpricing leads to income reduction, underpricing is the lord of losses. If you underprice to avoid turnover, you may solve the vacancy problem, but it will create long-term losses. It is especially important to price it appropriately in high-demand markets where rent is constantly rising. Remember, losing even $150/month adds up to $1,800 per year per unit.

The Hidden Cost of “Playing It Safe”

Whether it’s overpricing or underpricing, the common thread is this: most landlords don’t actually know what their units should rent for. They’re guessing and that guesswork is costly.

A single month of vacancy in a $2,000 unit equals an 8.3% annual revenue loss.

Undervalued leases across 5–10 units can reduce your portfolio’s NOI by tens of thousands.

These revenue shortfalls should be enough for you to understand that you need to adopt a smarter pricing method to make it big in the business.

What Is Rental Rate Optimization?

Rental rate optimization is the practice of setting the right rent for the right unit at the right time. ROO determines rates by using real-time data, market demand, and property-specific performance. It’s not about charging more. It’s about charging smart.

The core goal? Maximize net operating income (NOI) while keeping vacancy rates low.

How Does It Increase NOI and Reduce Vacancy

Optimized pricing uses data models that track seasonality, tenant behavior, and market fluctuations; then adjusts dynamically.

This approach ensures that each unit is priced to match what the market can bear today, not what it could six months ago. As a result, landlords can avoid overpricing that leads to long vacancies or underpricing that silently erodes long-term revenue.

Strategic Pricing vs. Reactive Pricing

Think of it as shifting from reactive rent changes (usually in panic mode after a unit sits empty) to proactive, precision-based adjustments that align with cash flow strategy. In a margin-sensitive industry, small tweaks $50 here, $100 there can quickly compound into serious gains across a portfolio.

Rental rate optimization isn’t just a pricing tool. It’s a revenue system.

What Great Pricing Looks Like

Great rental pricing doesn’t chase the market; it anticipates it. In short, great pricing is local, timely, informed, and aligned with your NOI targets.

Aligned with Local Demand

It’s grounded in local demand, responsive to real-time data, and aligned with the performance of each specific unit.

That means pricing a one-bedroom downtown loft differently in June than in December. It means adjusting rent not just by ZIP code, but by floor level, view, renovation status, and how quickly similar units are leasing nearby.

Adjusted to Seasonality and Unit Performance

Seasonality matters, too. A unit listed in peak rental months might carry a premium. While one hitting the market in a slow season may need a temporary discount. But not blindly, only with strategy. Smart pricing balances temporary concessions with long-term cash flow goals.

Predictive, not Reactive

Most importantly, great pricing is predictive, not reactive. It forecasts where the market is going, not where it’s been. If your pricing only adjusts after you’ve lost two months of rent, you’re already behind.

Tied to Cash-Flow Goals

And finally, it’s strategic. The best landlord's price with intent: whether to boost occupancy, target a renewal, or reposition a property. The numbers support the bigger financial plan, not just today’s lease.

How AI Makes Pricing Smarter

Artificial intelligence doesn’t guess; it learns. That’s what makes it a game-changer for rent optimization. Instead of relying on scattered comps or static averages, AI analyzes thousands of data points to determine what your unit should rent for, and why.

Demand Pattern Detection and Rent Forecasting

AI-powered systems ingest real-time leasing activity, neighborhood trends, seasonal patterns, and economic signals. They detect subtle shifts in demand, like a rise in searches for two-bedroom units in a specific school district. Then they suggest adjustments before vacancies hit.

Evaluating Your Portfolio for Smarter Decisions

Beyond external signals, AI also looks inward. It studies your historical leasing data: how long each unit took to rent, which floor plans command higher rent, and when renewal rates drop. This portfolio-level intelligence helps fine-tune pricing by property, building, and even by floor.

Occupancy-Based Rent Adjustment

Occupancy-based pricing is another powerful advantage. If a building is 98% full, the system knows you can push rents slightly. If it's 70%, it flags the need for promotional pricing or flexible lease terms. The result? Fewer empty units and more cash in your pocket.

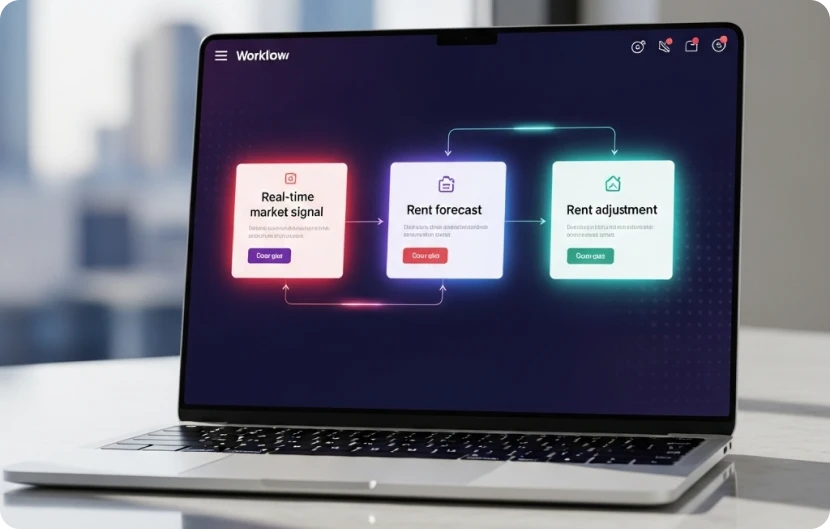

MatrixTribe’s Approach to Rent Intelligence

At MatrixTribe Technologies, we don’t just build software, we build foresight. Our Rent Intelligence system is designed to give landlords a strategic edge. We ensure the rent growth of your property matches the market.

Plug into Real-Time Market Signals

It starts with real-time market signals. We plug into active leasing data, not outdated listings or test ads. So, your pricing decisions reflect what tenants are actually paying today, not what someone posted last month.

Forecast Churn and Revenue

Next, we forecast both churn and revenue. Our AI models detect early signs of tenant turnover. Then predict how changes in rent, seasonality, or amenities might impact your income. No more waiting for vacancies to reveal weak spots in your strategy.

Suggest Rent Adjustments Before Problems Arise

Finally, our machine learning platform doesn’t just analyze it advises. You’ll get proactive prompts for when to raise, hold, or adjust rent based on performance goals, demand indicators, and risk thresholds. Think of it as a pricing strategist working quietly in the background, always watching the data so you don’t have to.

Rent doesn’t have to be a gamble. With MatrixTribe Technologies, it becomes a lever for growth.

Final Thoughts: Rent Strategy Is Cash-Flow Strategy

Rent pricing isn’t just about staying competitive; it’s about staying solvent. A $100 mistake repeated across 10 units for 12 months is $12,000 in lost income. That’s not minor. That’s the difference between growth and stagnation.

Predictable income begins with intelligent pricing. Not reactive guesses. Not spreadsheet guesswork. True strategy requires visibility, forecasting, and tools that evolve with the market.

Landlords who still rely on gut instinct are leaving money and opportunity. With smarter tools and AI-driven insights, rent pricing becomes not just more accurate but more powerful. It’s time to move beyond the old playbook.

Ready to Stop Guessing and Start Earning More?

Don’t let another month of underpriced units or costly vacancies drain your portfolio. With smarter pricing powered by AI, you can unlock higher returns and stable occupancy starting today.

Talk to MatrixTribe and see how Rent Intelligence can transform your cash flow.

Latest Article